Market Matters: Markets Shake Off Inflation Worries.

Market Matters 158 – Markets shake off Inflation worries

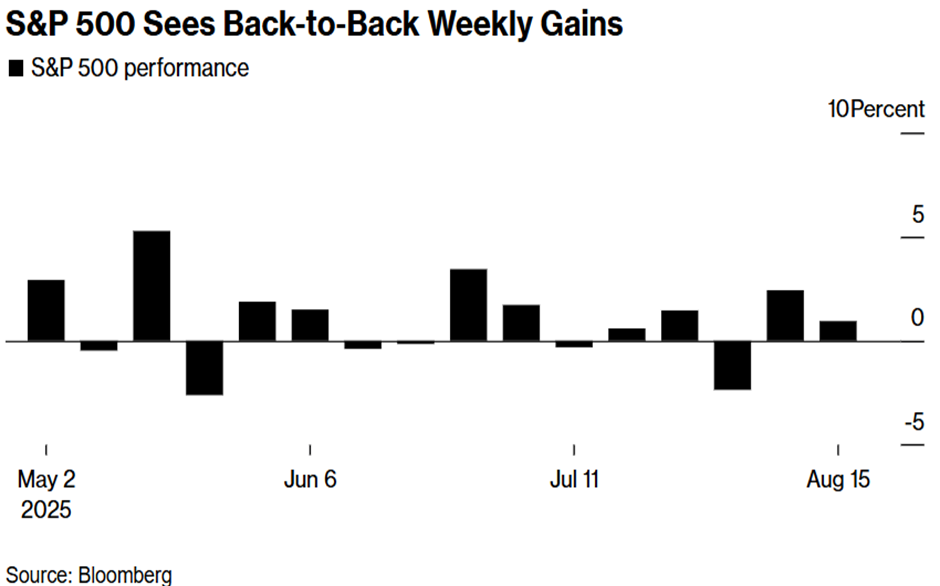

Despite a steady flow of data that might once have rattled investors, particularly stickier inflation and softer sentiment, equity markets again showed resilience that is hard to ignore. In another cycle, these numbers might have sent markets reeling and the Fed mulling further tightening, not easing, let alone the half-point cut Scott Bessent has been urging. Yet here we are; markets remain convinced that September will deliver a cut, with more likely before year-end…

Even with the prospect of rate cuts, valuations are stretched, no question. However, the willingness of investors, especially retail buyers, to buy on any dip is proving challenging to fight. Flows back into US equity funds tell their own story. Momentum remains the market’s best friend, and the Goldilocks scenario, softer labour data, still-healthy spending, and a Fed under pressure to ease could yet play out a while longer. The US consumer may be fretting, with sentiment indicators sliding, but in practice, they’re still spending.

Politics, too, added a layer of intrigue. Donald Trump rolled out the red carpet for Vladimir Putin in Alaska, promising ‘many points of agreement’ but leaving the details vague. Putin spoke of an ‘understanding’ that could open the door to ending the war in Ukraine, while warning Kyiv and European capitals not to obstruct progress. The short, tightly choreographed press conference, no questions taken, left allies uneasy, markets watchful, and plenty of room for speculation. Headline risk remains very much alive. But there was also a sense of relief that a deal hadn’t been reached, which might have seen Trump promising Ukrainian land to the Russians.

With that backdrop, let’s turn to the details of the week’s US data, including CPI and PPI, as well as retail sales and confidence, and see how the numbers align with the narrative.

United States – Inflation, Prices and the Consumer

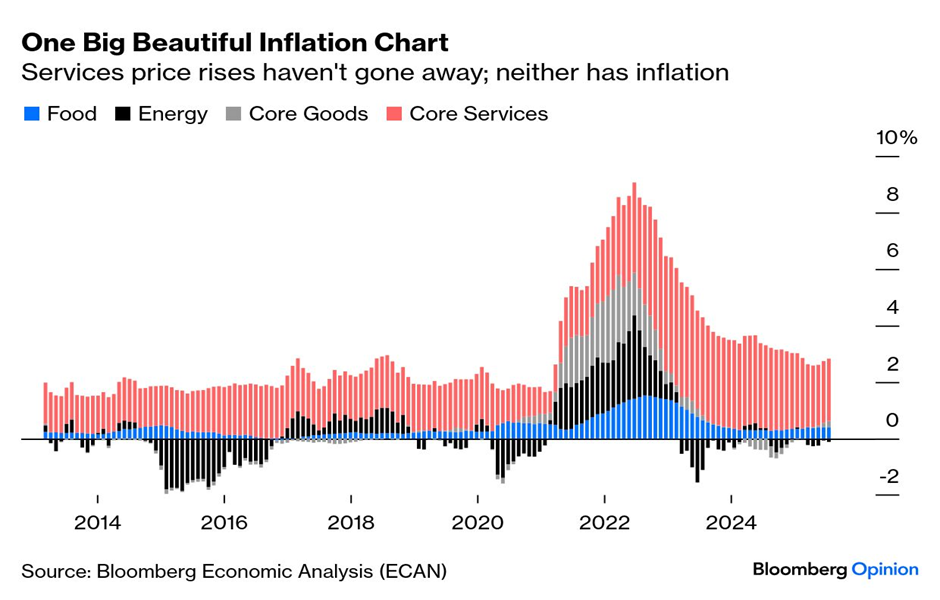

The US data run this week left plenty for investors and policymakers to digest. Inflation prints showed that disinflation has stalled, if not reversed. The headline CPI eased to 2.7% year-over-year, thanks to cheaper gasoline, but core inflation remains around 3%. The Fed’s favoured supercore measure (services excluding shelter) edged up to 3.2%, its highest since April, while sticky-price indices and the Cleveland Fed’s median CPI also ticked higher. Under the surface, more categories of goods are starting to register tariff pass-through, with 65% of core goods prices rising in July, compared to 57% the month before.

Producer prices underlined the point. The PPI for final demand rose 0.9% month-over-month and 3.3% year-over-year, the hottest reading since February. Much of this strength stems from services, but intermediate goods costs are also creeping higher, partly due to tariffs on inputs such as metals. I will reiterate the point: the data suggests that inflation remains a problem, and if the Fed had only one mandate to control inflation, it would be more likely to raise rates than cut them.

Against that backdrop, retail sales offered a reminder of the resilience of the US consumer. Headline sales rose 0.5% in July, with autos and online promotions doing the heavy lifting, and June was also revised higher. The University of Michigan sentiment index dropped to 58.6 from 61.7, the first fall since April. Inflation expectations nudged up as well. But what consumers do matters more than what they say, and for now, they are keeping the flywheel turning.

This scenario is the paradox the Fed faces. By most historical standards, rising inflation alongside steady consumption would suggest a case for tightening. Instead, political and market pressure for a cut is growing louder. Scott Bessent openly called for a half-point ‘jumbo cut,’ while Fed governor nominee Steven Miran dismissed tariff pass-through as little more than a one-off blip. Markets still price September as a done deal, with further easing expected by year-end.

So, a reminder of why Trump and his cronies are pressing so hard for rate cuts. Lower official rates can filter quickly through to cheaper credit for households, including mortgages, car loans, and other consumer lending, thereby providing a timely boost to growth as the midterms approach. A buoyant economy, resilient consumer demand and rising equity markets are all part of the electoral calculus.

Yet the risk is that such a strategy backfires. Much of the cost of borrowing in the United States is not directly set by the Federal Funds rate, but rather by longer-dated Treasury yields. Should investors conclude that the Fed is bowing to political pressure, credibility would be undermined, and the bond vigilantes (the one truly independent force in markets) could reappear with a vengeance. A determined sell-off in Treasuries would send yields sharply higher, pushing up the cost of mortgages and corporate borrowing. That was precisely the pattern witnessed last year, when premature easing led to a rise in long-term rates that more than offset the intended cut.

It is therefore a dangerous gamble. Seek to engineer cheaper money at the front end, and one may inadvertently tighten conditions further out, where households and companies borrow most heavily. For the Fed, the challenge is not merely balancing inflation and employment, but preserving its independence. Lose that, and the entire ‘Goldilocks’ scenario markets are banking on begins to look decidedly fragile.

Jackson Hole Symposium

All of which brings us neatly to Jackson Hole next week. For context, the symposium has grown from a niche gathering in the late 1970s into one of the most influential fixtures in the central banking calendar. Each August, policymakers, academics and investors converge in Wyoming’s Grand Teton mountains to debate the global economic outlook.

Ben Bernanke used the platform in 2010 to prepare the ground for quantitative easing. Janet Yellen signalled in 2016 that the Fed was ready to raise rates after years of ultra-loose policy. Markets now parse every nuance of the keynote address, knowing it can foreshadow moves that shape the year ahead.

For Jerome Powell, the balancing act is as delicate as ever. The Fed’s dual mandate is price stability and maximum employment. While inflation is not back to target, the recent revisions to payrolls and the softening in sentiment provide enough evidence for those who argue that a cut can be justified.

The labour market is no longer running white-hot. Job creation has slowed, vacancies are declining, and wage growth, although still elevated, is moderating. Taken together, these point to an economy that is cooling at the margin, perhaps enough to allow the Fed to ease without completely surrendering its inflation-fighting credibility.

That is what makes Powell’s words at Jackson Hole so significant. Markets have already priced in a September cut as a certainty. The question now is whether he validates that expectation, cautions against the political clamour, or signals a more modest path of easing. Either way, it will set the tone not just for rates, but for how much longer this ‘Goldilocks’ moment for markets can be sustained.

China

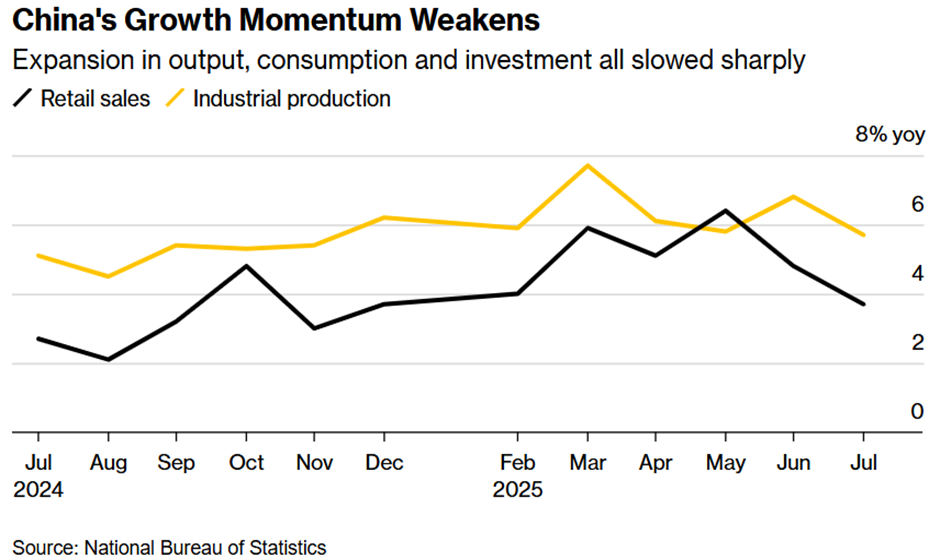

If the US is still wrestling with sticky inflation, China’s problem is the opposite. July’s data showed a clear loss of momentum: factory output slowed to 5.7% year-on-year, retail sales eased to 3.7%, the weakest this year, and fixed-asset investment decelerated to just 1.6%. The jobless rate edged up, and new loan growth contracted for the first time in two decades, highlighting a softening appetite for borrowing and spending.

Markets, however, chose to see the glass half full. Equities rose on the logic that the weaker the data, the greater the chance of fresh stimulus. Beijing has so far relied on piecemeal measures, such as childcare subsidies, consumer loan support, and trade-in schemes, but investors are betting that policymakers will reach for something bigger as the autumn slowdown bites. The challenge is that policy support is proving less potent than in past cycles. Subsidies are already losing traction, and curbs on destructive price wars in sectors from autos to steel are weighing on new investment.

Looking ahead, August’s data will be watched closely to judge whether the slowdown is becoming entrenched. Many expect further measures in late September or early October, although they are likely to be on a smaller scale than last year’s packages. For now, markets remain locked in a ‘bad news is good news’ mindset with each disappointing release taken as confirmation that more support is on the way.

Europe & UK

As China is flirting with stimulus hope, Europe looks steadier. The latest GDP data showed the Eurozone eked out 0.1% growth in Q2, a touch better than expected and enough for forecasters to nudge 2025 growth up to 1.2%. Spain remained a bright spot with robust momentum, while France surprised on inventories. Germany and Italy slipped slightly, but the overall picture suggests the bloc is closer to bottoming out than sliding further.

Surveys have also been more encouraging, with PMIs reaching an 11-month high in July, although the early August reading hints at some softening. Inflation is anchored around 2%, allowing the ECB to pause for now. A further rate cut in December remains possible. However, unlike the US, policy rates are already low and fiscal levers are still available, particularly in Germany, where spending plans are set to expand.

Equities have reflected this shift. European stocks have outpaced their US peers year-to-date, though the gap has narrowed recently, and the region has been fertile ground for active managers. Value and earnings upgrades have created plenty of dispersion, and funds like Artemis SmartGARP European Equity have thrived (delighted to say this is a fairly universal 8AM AQ pick), up over 40% this year, with gains driven by banks, insurers, and travel & leisure, while steering clear of expensive defensives and tech. That success highlights how Europe, long dismissed as uninvestable, has quietly become the sweet spot for stock-pickers in 2025.

The newly signed EU–US trade agreement has reduced some uncertainty, though risks of sector-specific tariffs linger. External demand remains fragile, but domestic conditions are more resilient, with unemployment sitting close to historic lows, which supports consumer spending. In short, the Eurozone economy still faces challenges, but unlike in recent years, the bias now feels towards stability rather than renewed deterioration.

Across the Channel, the UK delivered a small but important upside surprise. GDP grew 0.3% in Q2, helped by a sharp 0.4% rebound in June across services, manufacturing and construction. It’s still a slowdown from Q1’s stronger pace, but far better than the contraction many feared after weak spring prints. For Rachel Reeves, the timing is useful: firmer growth, coupled with the Bank of England’s recent rate cut, gives her a little more room to frame the Autumn Budget around investment and reform rather than firefighting. The fiscal squeeze and tariff headwinds haven’t gone away, but a steadier growth backdrop allows Reeves to argue from a position of cautious strength, one that markets will be watching closely.

This Week…

Geopolitics and central banking will dominate the stage this week. President Zelenskiy arrives in Washington on Monday, urged by Trump to ‘make a deal’ in the wake of his meeting with Putin. Markets will be keen to see whether this yields substance or merely more spectacle, and whether Europe is invited to the table or left watching from the sidelines.

Later in the week, attention turns to Jackson Hole, where Jerome Powell delivers his keynote on Friday. With September’s rate cut a done deal in the minds of investors, any hint that this might not be forthcoming could rock the markets. There are no fresh payrolls before then, so investors will take their cue from Powell’s words and the drip-feed of weekly jobless claims. Between the politics in Washington and the policy signals from Wyoming, it could prove a defining week (amongst defining weeks) for both diplomacy and markets.

DOWNLOADS

There are currently no downloads associated with this article.