Market Matters – Investor fatigue shows up as we approach Q3 end

Market Overview

Markets seemed to lose a bit of steam last week. After a strong run through the summer, investor appetite flagged as quarter-end approached, with some locking in gains alongside scheduled portfolio rebalancing. It wasn’t a dramatic reversal — more fatigue than fear — and while the major indices finished the week lower, they steadied into Friday on the back of ‘in-line’ inflation data. Beneath the surface, the macro picture was anything but quiet: GDP growth remained robust, consumer spending surprised to the upside, and retail sales proved resilient. In short, a pause for breath rather than a change in direction as we head into the final quarter of the year.

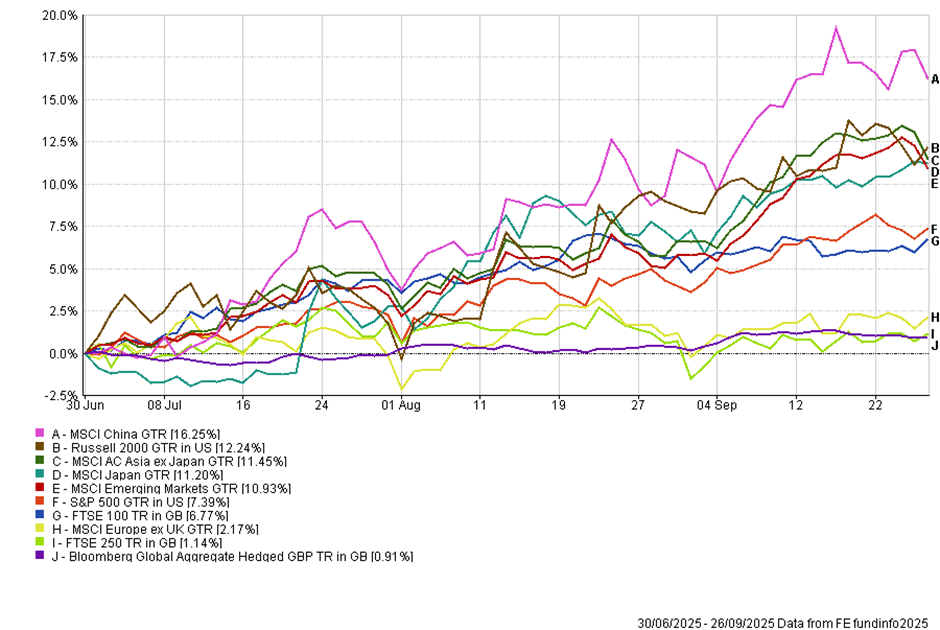

Quarter-to-date returns still paint a broadly positive picture, albeit with some clear divergences. China has led global markets with gains of more than 16% since the end of June, while US small caps and Asia ex-Japan have also delivered double-digit returns. Japan, emerging markets, and the S&P 500 are not far behind. Closer to home, the FTSE 100 has risen around 7–8% on the back of solid earnings, while mid-caps in the FTSE 250 have lagged with only modest gains. Bonds, meanwhile, have added little, reinforcing equities as the asset class of choice in this late-summer rally.

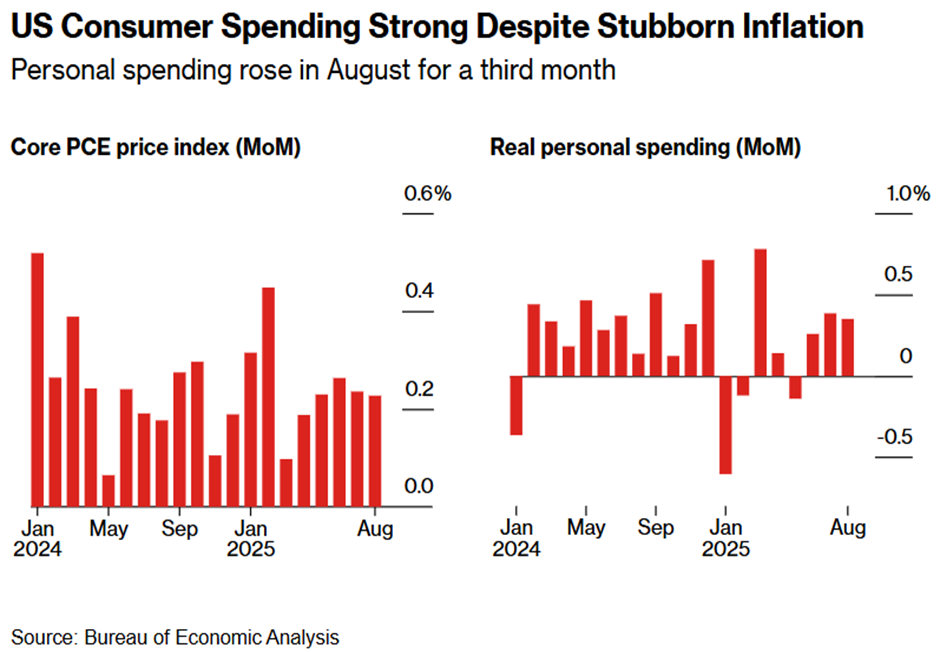

If there was one standout data point last week, it was the strength of US consumer spending. Real personal consumption rose 0.4% in August — the third consecutive monthly gain and double consensus expectations — underlining just how much households are continuing to drive the economy forward. Goods demand, especially discretionary categories such as furnishings, clothing, and recreational equipment, led the way, while services spending grew more moderately. That resilience helped lift Q2 GDP growth to an upwardly revised 3% annualised pace, keeping the ‘soft landing’ narrative very much alive.

However, the picture is not without weakness. The saving rate has dropped to 4.6%, the lowest level this year, suggesting that consumers are dipping into their buffers to maintain momentum. Wages are growing more slowly, disposable income has barely budged, and consumer sentiment fell to a four-month low in September, driven by concerns about income and inflation. In other words, spending remains strong, but the foundations appear less stable than the headline numbers suggest.

On the inflation front, the Fed’s preferred gauge, core PCE, rose 0.2% month-on-month, leaving the annual rate stuck at 2.9%. Headline PCE is running at 2.7% year-on-year. Both were in line with expectations and not alarming in isolation, but they remain well above target. Services inflation in particular is proving stubborn, even as goods prices ease thanks to discounting in categories like appliances and recreational goods. Tariffs are slowly feeding into costs, though Powell noted their inflation impact so far has been smaller than feared.

Friday’s data only reinforced the sense of an economy still running hot. Q2 real GDP growth was lifted from 3.3% to 3.8% (saar), with real consumer spending revised sharply higher from 1.6% to 2.5%. The Atlanta Fed’s GDPNow model was also upgraded, currently tracking Q3 growth at 3.9% — pointing to back-to-back quarters of solid momentum. At the same time, initial unemployment claims remain low, even as payrolls were marked down by a significant benchmark revision. The combination suggests productivity growth may ultimately be revised higher, highlighting the resilience of output even as headline employment data cools.

Against that backdrop, last week’s Fed rate cut looks more a nod to softening labour data than to any pressing weakness in demand. However, demand scarcely needs reviving — consumption is strong, growth is robust, and inflation remains persistent. By easing into this environment, the Fed risks stoking inflation pressures and pushing bond yields higher, not to mention fuelling the kind of melt-up in equities that often ends in a disorderly and painful correction. The structural challenges in the labour market — from demographics to illness to the disruptive role of AI in entry-level jobs — are unlikely to be solved by monetary policy. Which leaves the Fed walking a very fine line: cutting to support jobs, while risking overstimulating an economy that already looks anything but weak.

Still, for investors, a strong economy is ultimately good for earnings — and the next reporting season is not far away. Tariffs may yet impact corporate margins, but the bigger picture remains one of solid demand, healthy top-line growth, and a supportive backdrop for companies with pricing power. In the longer run, that makes for a constructive outlook, even if the near-term policy trade-offs keep markets on edge.

One more brief note on the US…

Only in Washington could the threat of a government shutdown become so routine that markets barely flinch anymore. Fourteen shutdowns since 1981 have left investors almost blasé to the idea. Agencies now have playbooks, workers expect furloughs and back pay, and equities rarely blink — even the record 35-day lapse in 2018–19 barely dented markets.

This time could be more disruptive, beginning on the first day of a new fiscal year with no appropriations bills passed and President Trump raising the stakes by threatening permanent layoffs of “non-essential” staff. A shutdown would also risk delaying key economic data, such as payrolls and CPI, leaving the Fed flying blind at a delicate moment.

Yet, for all the theatre, the most likely outcome remains familiar: a last-minute continuing resolution to keep the lights on, followed by another temporary patch when that one runs out. Investors assume the game of fiscal brinkmanship will stop short of real damage, which is why they remain largely unruffled. It is almost comical that the world’s largest economy can grind to a halt because lawmakers can’t sign off on the bills, but until markets punish the behaviour, the play looks set to continue!

UK: Fiscal Pickle Meets Bond Market Reality

If the US economy looks resilient, the UK’s challenge is more about credibility. The government finds itself in a fiscal pickle — not irretrievable, but increasingly hard to manage. Despite last year’s landslide, Labour is split between Reeves’ calls for discipline and the party’s instinct to spend. With the overall tax burden already at generational highs and “big” tax rises officially ruled out, the arithmetic gets harder by the week. The risk is policy drift that keeps everyone unhappy while doing little to reassure markets.

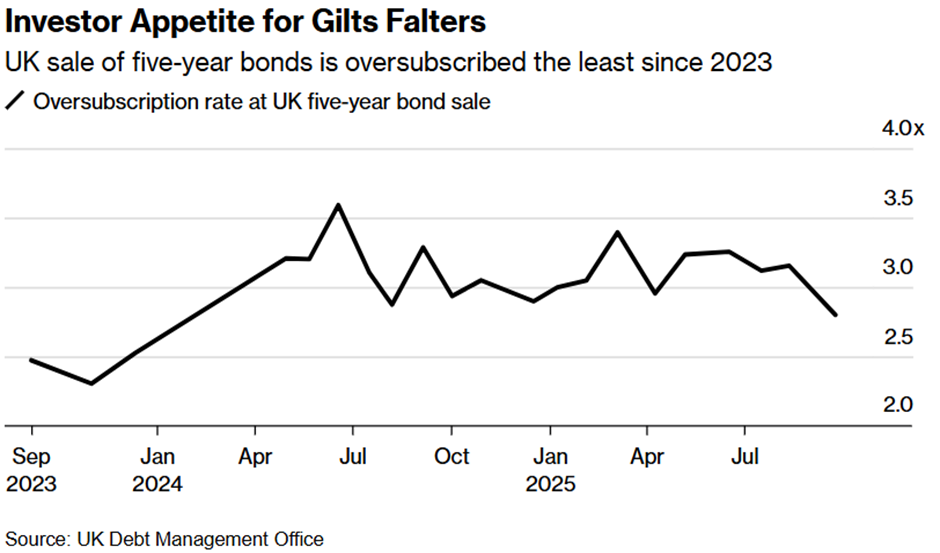

That unease is now showing up directly in the gilt market. Demand at this week’s bond auctions was the weakest in at least two years, with both 5-year and 30-year sales drawing thin order books. The Debt Management Office has already tilted issuance towards shorter maturities to reflect fading appetite from pension funds, so the wobble in shorter-dated auctions is especially notable.

Ten-year gilt yields jumped to 4.74%, their highest in three weeks, and remain well above German or US equivalents. Investors are clearly unsettled by the prospect of higher borrowing, policy U-turns, and the OBR’s expected productivity downgrade, all of which point to a widening hole in the public finances. Reeves will get another chance to steady the ship at Labour’s annual conference this week, but until November’s budget, speculation will only grow.

In the background, the macro picture is softening. The composite PMI slipped to 51.0, services activity eased, and manufacturing remains fragile. That keeps the case alive for a BoE rate cut, but sticky services inflation means the Bank is unlikely to move aggressively. For now, the gilt market is setting the tone: the cost of credibility is rising, and with investors voting with their wallets, fiscal discipline is fast becoming more than just a political slogan.

For all the noise around gilts and fiscal arithmetic, UK equities continue to hold their own. The FTSE 100 has outperformed the Nasdaq 100 year-to-date in sterling total return terms. Analysts see fair value closer to 10,500, versus today’s 9,200, leaving the index with a margin of safety that is hard to find in most major markets. The FTSE 250 has been less sparkling, but still offers selective opportunities, particularly given the increasing resurgence of M&A activity targeting our medium-sized companies.

Who’s going to drive the buying of listed equities? Global fund managers remain cautious, but UK corporates themselves have stepped in: more than half of large listed companies have repurchased at least 1% of their shares over the past year, a higher proportion than in the US or Japan. That appetite, coupled with resilient earnings from banks, industrials, and defensives this summer, has helped underpin the market. And while fiscal policy could yet deliver sector-specific bumps in November’s budget, the advantage of buying into cheaper markets is that much of the bad news is already in the price.

The longer-term backdrop may also be turning more supportive. The structural shift out of equities by defined benefit pension funds is essentially done, and as defined contribution schemes grow in scale, their higher equity allocations should become a tailwind. Combine that with ongoing foreign bids for undervalued UK assets, and the case for selective UK equity exposure looks stronger than the headlines suggest.

Europe: Divergence Behind the Headline

Eurozone activity looked firmer on the surface last week, with the flash composite PMI rising to 51.2, its highest in 16 months. That suggests the bloc is still expanding, but the details told a more complicated story. Services continued to underpin growth, while manufacturing slipped back into contraction at 49.5, and new orders stalled right on the 50.0 breakeven line. Hiring momentum also cooled, marking the end of a six-month run of job creation.

The divergence between the region’s two largest economies was stark. Germany’s PMI climbed above 52, signalling a steady recovery, while France slipped deeper into contraction at 48.4, with political uncertainty and fiscal strain clearly weighing on business confidence. In effect, Germany is currently supporting the eurozone — leaving the aggregate data more vulnerable should its rebound falter.

Furthermore, inflation appears poised to complicate the picture. Forecasts suggest that the eurozone’s CPI rose to 2.2% in September, its highest level in five months, driven by energy costs and seasonal airfare increases. The national releases are expected to show a broad-based pickup across Spain, Italy, Germany, and even France. While the ECB tends to look through such volatility, a reading back above target is likely to reinforce the case for holding rates steady when policymakers meet at the end of October. The next significant policy inflexion point will occur in December, when new staff forecasts are due.

For markets, the message is mixed: Europe is still growing, but barely. Headline inflation may have re-accelerated; and the ECB is in no hurry to ease further. European equities have held their ground, buoyed by banks and defence stocks, but the underlying message is one of fragile progress rather than robust recovery.

Asia & Emerging Markets: China Leads, But Clouds Remain

China has been the star performer this quarter, with equities delivering some of the strongest global returns. Tech has led the charge, not least Alibaba, which jumped to a four-year high after unveiling its trillion-parameter AI model and drawing fresh interest from global investors. The revival of China’s internet and AI complex has reinforced the sense that, at least in relative terms, valuations are attractive and sentiment is turning a corner.

The hard data also offered some encouragement. Industrial profits surged 20.4% year-on-year in August, the first increase in four months, helped by policy campaigns to curb overcapacity and stabilise competition. For the first eight months of the year, profits eked out a 0.9% gain versus expectations of a decline. Strength was evident in equipment manufacturing, where railway, shipbuilding, and aerospace earnings surged more than 37%, while steel returned to profitability as prices stabilised and costs decreased. Even consumer product manufacturers saw a modest rebound.

Yet the outlook remains complicated. Domestic demand remains subdued, the property slump continues to weigh on construction and infrastructure, and tariff uncertainty persists in the background. Factory deflation has eased, but industrial output growth is still decelerating, which could limit the extent of the profit recovery. In other words, there are green shoots, but they’re sprouting in patchy soil.

Across the broader EM complex, the picture is mixed. Asia ex-China has lagged but still posted double-digit gains this quarter, thanks to semiconductor and AI-related hardware plays. Elsewhere, commodity exporters remain beneficiaries of resilient demand, while fiscal and external imbalances keep others on the back foot. Investors are increasingly selective, but with China leading returns and broader EMs catching a bid, the region remains an important source of diversification — albeit one that still comes with plenty of caveats.

This week… The US jobs report will be the main event, testing whether softer payrolls are cyclical or structural, and whether wage growth stays sticky. In Europe, September inflation data will guide ECB thinking, while in the UK, Chancellor Reeves’ Labour conference speech will be watched for any signals ahead of November’s budget. Asia’s PMIs and policy signals from Beijing will show if China’s profit rebound can extend, while AI momentum keeps tech in focus.

DOWNLOADS

There are currently no downloads associated with this article.