Markets continue their upward march

September ended without the drama many had feared, and October has begun on a quietly confident note. Equity markets moved higher again last week, with both the S&P 500 and Russell 2000 setting fresh highs as even the government shutdown failed to dent sentiment. With non-farm payrolls postponed and a partial data blackout in place, investors might have been forgiven for stepping back, yet markets climbed anyway. It was also a week light on mainstream economic news and macro data, thankfully, which is unusual and a welcome pause after a hectic few months. This update will also examine the developments in some alternative asset classes, where movements have been anything but quiet.

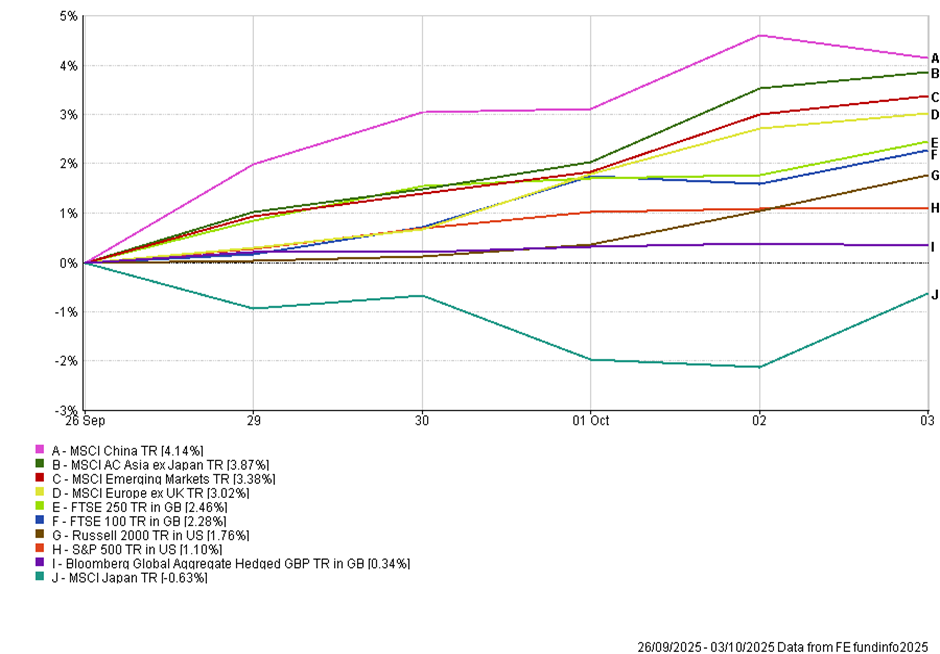

It was another week of resilience, the latest in a long series that continues to defy the sceptics. China extended its rebound, with Europe joining the party, posting gains of more than 3%. The UK also had a decent week, as the Labour Party conference passed without incident. Only Japan lagged, which is striking given its strong performance for most of the year. The tone elsewhere was quietly upbeat. Bond yields edged lower, credit spreads stayed tight, and volatility remains subdued.

United States – markets look through the shutdown

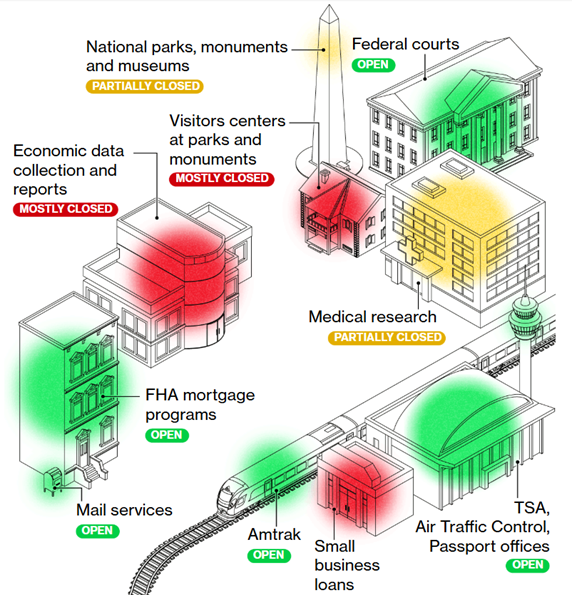

Government shutdowns have become a recurring feature of US politics, the product of partisan stand-offs that freeze parts of Washington while the rest of the world carries on. The latest closure, the third under President Trump across his two terms, began on October 1st after Congress once again failed to agree on a stopgap spending bill. Federal agencies have now begun implementing their contingency plans, with most economic data suspended and around three-quarters of a million workers on furlough.

The details are messy, as ever: Democrats are demanding renewed healthcare subsidies and limits on Trump’s spending discretion, while Republicans push for deeper cuts. A temporary funding patch may yet appear, but the deadlock shows few signs of breaking quickly. The practical impact, though, remains limited. Essential services continue, pay will eventually be backdated, and markets have long since learned to tune out the noise. Investors seem more amused than alarmed. The shutdown has delayed the release of the non-farm payrolls and other key reports, but the absence of data hasn’t dented confidence. Equities are still near record highs, the dollar has been steady, and bond yields have drifted lower. Past experience suggests that even a multi-week closure has little long-term economic impact once spending resumes.

For markets, this is little more than a political sideshow, a reminder of Washington’s dysfunction, but not a reason to change positioning. The real story remains earnings and interest rates, not empty museums or closed visitor centres.

US earnings outlook – can results justify the rally?

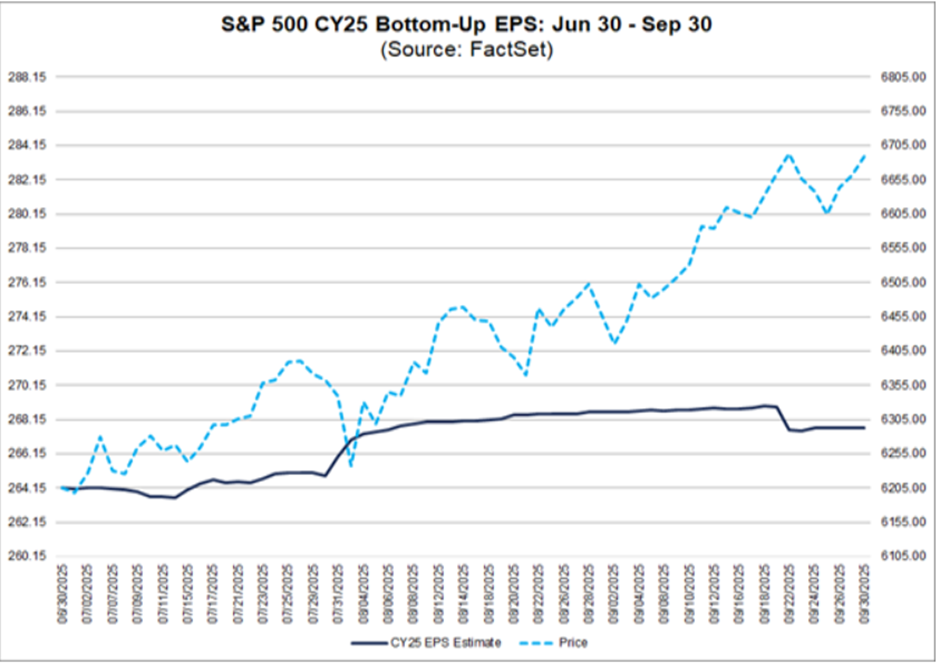

With politics providing more noise than signal, attention now turns to earnings season, and this time, expectations have actually been drifting higher rather than lower. For the first time since late 2021, analysts have raised aggregate EPS estimates for the S&P 500 during the quarter, rather than cutting them. It’s only a modest 0.1% increase, but it breaks a long run of downgrades and hints at quiet confidence in corporate resilience.

According to FactSet, bottom-up forecasts for the third quarter rose to $67.41, while estimates for full-year 2025 and 2026 were also revised higher, by 1.3% and 1.2% respectively. Upgrades were concentrated in energy, technology, and communication services, offset by downgrades in healthcare. The broader message is that margins remain intact and the earnings cycle has stabilised despite persistent headwinds from inflation and tariffs.

That optimism is reflected in valuations. The S&P 500’s forward P/E has climbed back above 22.6, its highest since 2021, having fallen to 18 during the April correction. The multiple on the so-called Magnificent Seven has rebounded from 22 to around 30 times forward earnings. Nearly half of the S&P 500 now trades at a price-to-earnings ratio of 20 or higher, and fewer than 8% of stocks are in single-digit territory.

High valuations don’t cause bear markets, whereas recessions typically do. What markets are discounting now is a kind of ‘Goldilocks Plus’ scenario, rate cuts without recession, fiscal stimulus still in play, inflation cooling but not reigniting and a steady lift from AI-related spending and productivity gains. It’s not euphoria, just the belief that growth can stay warm enough to sustain earnings while policy gradually turns supportive. If that balance holds, today’s elevated multiples start to look less reckless and more a reflection of an economy that refuses to slow down.

Even so, the coming weeks will test that conviction. FactSet’s aggregate margin estimate for Q3 stands at 12.7%, slightly below the previous quarter but still above the five-year average. Tariff pressures are beginning to show at the company level: consumer goods groups have flagged rising input costs tied to metals and Chinese components, and some have already warned of modest price increases to protect margins. In the tech sector, supply-chain rerouting and new export controls are complicating guidance for semiconductor and hardware companies, although overall sentiment remains sanguine.

The key, for now, is that these pressures have not derailed the earnings outlook; they’ve merely capped the upside. Index-wide margins remain healthy, pricing power is still evident, and analysts are marking numbers up, not down. If companies can deliver on that confidence through their results during the season, the market’s elevated levels may prove justified. If not, a little air could yet come out of the valuations balloon.

Looking beyond equities…

With most major equity markets treading water and little fresh data to digest while the US government shutdown continues, there’s not much new to say on the global stock picture this week. Rather than rehashing what hasn’t changed, it’s worth examining the parts of the market that have been shifting, specifically the alternative space, where gold, crypto, and industrial metals have each reacted differently to the changing macro backdrop.

Gold – the next leg higher?

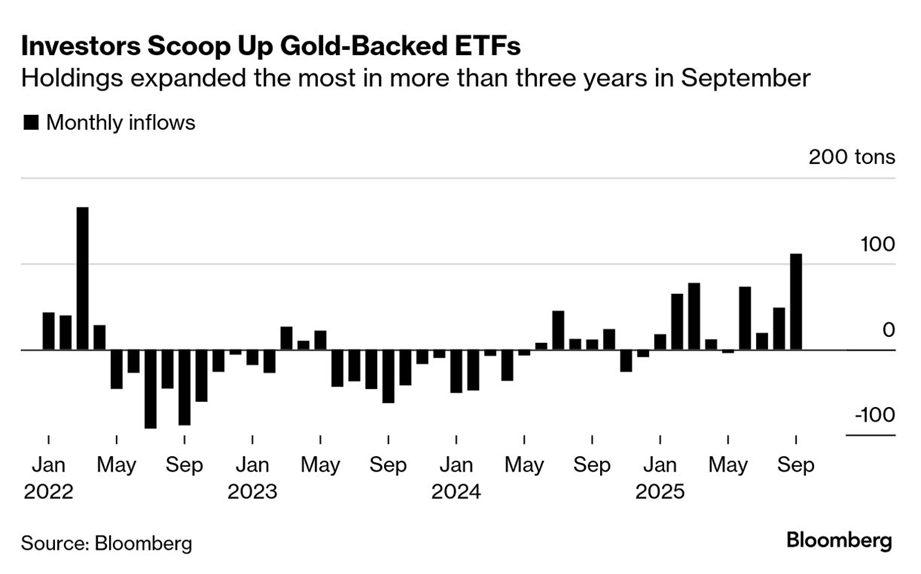

Gold was already on a tear before the latest political drama in Washington, but the shutdown has given it fresh momentum. The metal is trading near record highs, and a move through $4,000 an ounce no longer looks far-fetched. A combination of falling yields, a weaker dollar, and persistent inflation has created the perfect tailwind. Lower rates reduce the opportunity cost of holding gold, while lingering price pressures reinforce its appeal as a store of value. Add in political upheaval and an administration publicly sparring with the Fed, and investors have plenty of reasons to seek refuge.

The rally has also broadened beyond central banks and long-term allocators. Private investors have returned in force, with gold ETFs adding more than 100 tonnes in September, the biggest monthly inflow in over three years. That’s still well below the peaks of 2020, suggesting there’s room for further participation. Goldman Sachs reckons that if just 1% of privately held US Treasuries were rotated into gold, the price could approach $5,000 an ounce.

Central banks remain steady buyers, particularly in Asia, while China’s influence continues to grow as it builds out its own gold storage and trading infrastructure. Meanwhile, miners are enjoying a windfall with global gold producers realising record proceeds from share sales last quarter, with Zijin Gold’s $3.2 billion Hong Kong listing up nearly 90% in its first few days.

For now, the gold story is part inflation hedge, part crisis trade, and part momentum. As long as rates continue to drift lower and the dollar remains soft, the metal’s gravitational pull looks hard to resist. However, history suggests that when the headlines calm down, so does the shine.

Crypto – the Risk On & Risk Off trade!

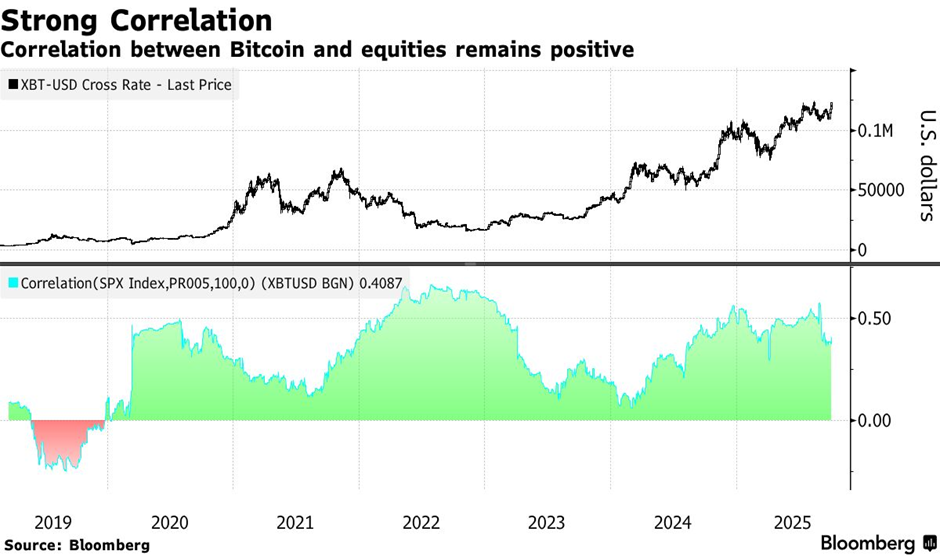

Bitcoin set yet another all-time high over the weekend, climbing to around $125,000 as the broader risk rally extended into digital assets. The world’s largest cryptocurrency has risen by more than 30% this year, aided by renewed inflows into Bitcoin-linked ETFs and growing speculation that the US government shutdown will ultimately erode confidence in the dollar.

Market participants have started calling it the ‘debasement trade’, the idea that with Washington paralysed, fiscal spending expanding, and rate cuts underway, tangible or finite assets like gold, property, and even collectables benefit as investors seek alternatives to fiat currency. Bitcoin, with its fixed supply and libertarian heritage, fits neatly into that story.

It also helps that October has historically been a strong month for the cryptocurrency market. ‘Uptober’, as traders call it. The token has risen in nine of the past ten Octobers, and a friendlier policy environment in Washington has reinforced this year’s rally. President Trump’s pro-business stance and a more accommodative approach to digital-asset regulation have encouraged corporates to add Bitcoin to their balance sheets, reviving memories of the 2021 bull run.

Whether this momentum is sustainable remains an open question. Bitcoin’s correlation with risk assets has tightened again, meaning its safe-haven credentials remain debatable. For now, though, it’s part of the same broader market pattern we’re seeing in equities, gold, and even collectables: a collective bet that policy will stay loose, inflation contained, and liquidity plentiful, all the ingredients of a ‘Goldilocks Plus’ scenario.

Copper – the real economy test

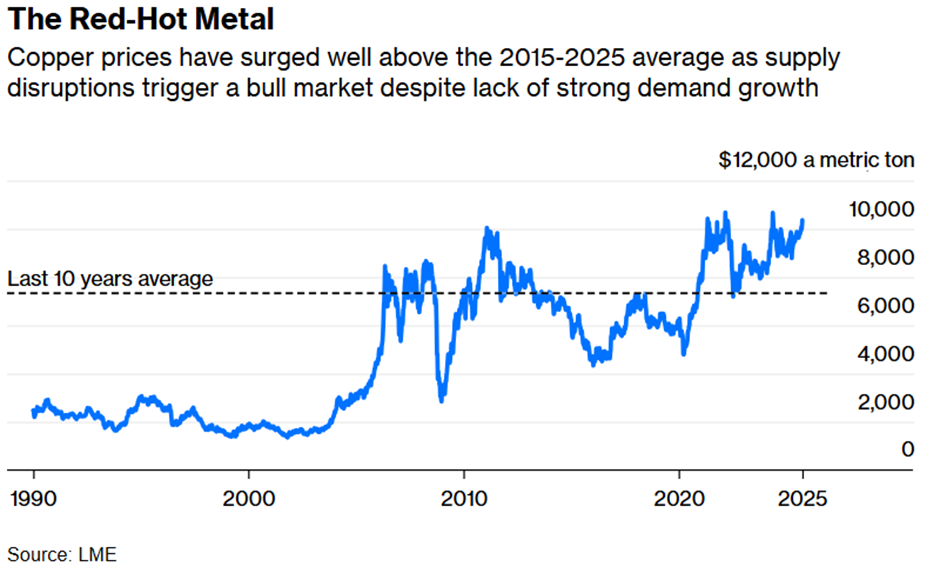

While politics and policy have driven gold and Bitcoin, copper’s message is more grounded in the real economy, and it’s a fascinating mix of near-term disruption and long-term promise. Prices have been firming again, hovering near $10,000 a tonne, supported by a series of supply shocks that have crimped output from some of the world’s largest mines. Flooding at the Congo’s Kamoa-Kakula mine, an accident at Chile’s El Teniente, unrest in Peru, and most dramatically, the September disaster at Indonesia’s Grasberg mine (the world’s second-largest producer) have all combined to remove significant tonnage from the market. Output isn’t expected to return to normal until at least 2027.

In commodities, there are two kinds of bull markets: good ones, driven by demand, and bad ones, powered by supply shortages. The former tend to last, and the latter usually fade. Currently, copper is clearly a supply-driven story. But it could yet turn into something more.

I’d argue the next phase could be a perfect storm where tightening supply meets rising demand. The AI boom is rapidly becoming a new source of copper consumption, as data centre expansion, high-voltage cabling, and advanced cooling systems add to traditional demand from electrification and renewables. Goldman Sachs estimates that AI infrastructure alone could lift global copper demand by up to two million tonnes a year by the end of the decade. Add in grid modernisation, EV growth and the broader energy transition, and the backdrop starts to look more like a good bull market than a bad one.

China remains the missing link for now. Its property sector is subdued, export orders are soft, and traders are reluctant to chase inventory, with Shanghai premiums still depressed. But that may simply delay rather than derail the next demand wave. Over the longer term, the world’s pivot toward electrification and digitalisation points to higher copper prices for the foreseeable future.

Back to the Equity Markets amid a quick check for bubbles amid the tepid (but warming) waters

The latest AAII survey shows a 43% bullish stance against a 39% bearish one, representing a modestly positive balance after a prolonged period of caution. Earlier in September, bearish readings had pushed near 50%, so this feels more like normalisation than exuberance. The CNN Fear & Greed index sits near neutral, and the NAAIM exposure index shows active managers running roughly 80% equity exposure, risk-on but hardly reckless.

Institutional tone has also improved. Bank of America’s Fund Manager Survey reports cash levels down to just under 4% and equity overweight’s climbing to a seven-month high, driven by renewed confidence in growth and the prospect of Fed cuts. It’s a noticeable shift: managers are moving back into markets, but not with both feet. There’s still nearly $7½ trillion parked in US money market funds, a record sum and a reminder that a significant amount of cash remains on the sidelines. Some of it is starting to return to ETFs and equity allocations, yet the overall positioning picture remains far from stretched.

At the same time, the press has rediscovered its favourite storyline – The Bubble! Commentators warn of inflated tech valuations, AI excess and speculative behaviour in crypto. But history suggests that when everyone is talking about bubbles, we’re usually not quite there yet. Surveys and flow data still indicate lingering caution, rather than euphoria. Call option volumes have indeed risen, but broad measures of positioning show a market that’s engaged rather than manic.

The mood could best be described as ‘reluctant confidence’. That mix tends to extend rallies longer than most anticipate. If earnings and economic data continue to support the Goldilocks Plus scenario (steady growth, easing inflation, and policy support), sentiment may continue to thaw without tipping into mania. But with valuations already rich and cash buffers shrinking, any real disappointment could see optimism fade just as quickly.

This week – earnings in focus

The week ahead will be dominated by corporate results as the government shutdown continues to disrupt the normal data schedule. The major US banks JPMorgan, Citigroup, and Wells Fargo report first and will provide an early test of the earnings season. Markets will focus on loan growth, deposit trends, credit provisions, and commentary on consumer and corporate balance sheets.

In Europe and the UK, the earnings calendar also accelerates, with several large industrial and consumer companies reporting. Investors will be assessing margin resilience and forward guidance amid softer demand and lingering cost pressures. In Asia, attention remains focused on export-sensitive sectors, with the latest data from China, where company updates will test recent signs of stabilisation. With few macro releases expected, earnings and corporate guidance will be the primary drivers of market sentiment in the week ahead.

DOWNLOADS

There are currently no downloads associated with this article.