Market Matters: When Bonds Start Barking

Market Overview

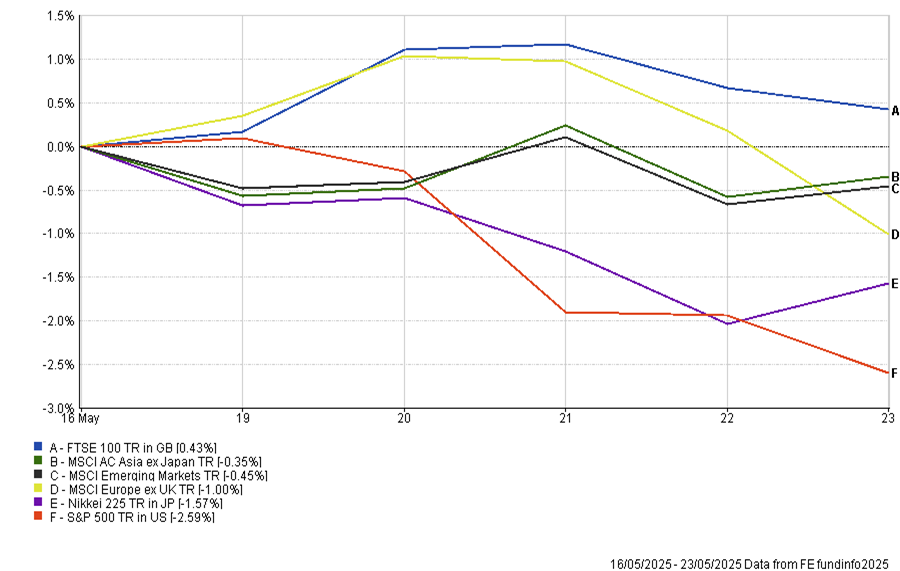

Last week’s modest pullback in most Equity markets wasn’t unexpected. After a sharp and enthusiastic rebound from the initial tariff-driven sell-off, investors were always likely to pause to reassess. The catalyst wasn’t a single event but a convergence of (again) US factors: a renewed rise in bond yields following Congress’s passage of Trump’s ‘Big Beautiful Bill’ and the reappearance of trade tensions, this time with the EU firmly in the crosshairs.

The combination of narratives last week, has brought back into focus a set of risks that markets had, until recently, been willing to look past. The shift higher in Japanese bond yields also spooked investors in that market. The UK was left as one of the few markets higher last week, with the FTSE 100 eking out a small weekly gain of 0.43% – likely by nature of staying out of global headlines!

Earlier last week, markets were looking relatively stable, but that calm gave way with confirmation that Trump’s ‘Big Beautiful Bill’, a sweeping package of tax cuts, had cleared the House. While the headline wasn’t surprising, the bond market’s response was striking. A weak 20-year Treasury auction sent yields sharply higher as investors reassessed the implications of an even looser fiscal policy layered on top of an already strained debt outlook. Equities quickly followed, with rising real yields tightening financial conditions and placing renewed pressure on valuations.

At the same time, tariff concerns resurfaced in both rhetoric and direction. The threat of 50% duties on EU imports before the current 90-day suspension expires unsettled markets into the close on Friday.

European Union: Tariff Target?

I would write at length to the specifics of the announced European tariffs on Friday, but the pace of change renders brevity more valuable;

Morning of May 23rd – 50% tariffs on all imports to the US from the EU – to be implemented 1st June.

The market’s reaction?

DAX -1.5%

CAC 40 -1.7%

Euro Stoxx 50 -1.8%

Afternoon of May 23rd – Ursula von der Leyen calls Trump, hinted at concessions around agricultural imports and digital services – tariff is delayed till July 9th.

Today (May 26th) European markets haven’t recovered all of Friday’s losses, but all are still firmly in the green at roughly the same proportion as the negative sentiment on Friday (the session is still open at the time of writing).

US futures are also pointing higher ahead of the open on Tuesday (they are also closed today). Investors are again leaning on the now-familiar pattern of grandiose threats followed by subsequent rapid policy U-turns from the White House.

While that may limit the immediate impact, the broader message holds: trade policy remains a key source of volatility in a more politically charged market environment.

Bond Vigilantes Flex

Before we start this section – lets clarify what a ‘Bond Vigilante’ is.

Bond ‘vigilantes’ are investors who sell government bonds when they lose confidence in a country’s fiscal or monetary discipline. When bond prices fall, yields rise – effectively pushing up borrowing costs for the government. It’s the vigilante’s saying: we don’t trust your budget, policies, or ability to repay without inflation or default. In the past, these investors have forced governments to rethink or reverse policy, as the UK discovered during the 2022 mini-budget crisis. And now, with US deficits widening and long-term yields climbing, there’s a growing sense that the bond vigilantes might be back, observing and ready to act if fiscal credibility slips too far.

With that out of the way – lets continue…

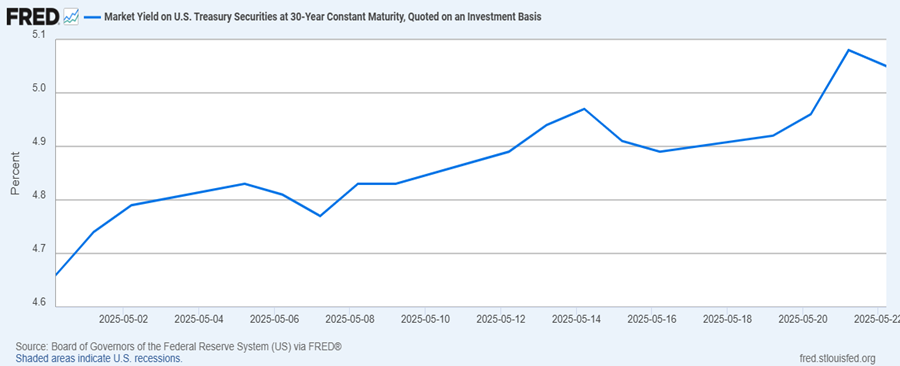

Last week’s most troubling development was the move in US bond yields. This isn’t a sudden shock as the chart below shows the US 30 Year has been trending higher all month as the pressure has been building for several weeks, but the latest spike is hard to ignore. The trajectory will be deeply uncomfortable for an administration with a publicly stated goal of decreasing yields.

What’s driving this is no longer just economic resilience or inflation surprises. The rise in long-dated yields increasingly reflects concerns about fiscal credibility, and is a market signal from the vigilantes that confidence in the US government’s ability to manage its debt profile is weakening. That matters well beyond Treasuries. US duration is still the anchor for global capital allocation, and if that anchor slips, the knock-on effects will be far-reaching.

We are beginning to see echoes of 2022, but this time from the long end of the curve. Then, the challenge was how far the Fed would take policy rates. It is about how far the bond market is willing to take yields on its own. The dynamic is familiar: rising yields drive up the cost of capital, compress valuation multiples, and tighten financial conditions even in the absence of central bank action. In this case, the move is driven not by rate hikes but by eroding demand for duration, a more dangerous development given its reflexive nature.

The underlying concern is credibility. The projected three trillion-plus dollar cost of Trump’s tax package over the next decade has already revived comparisons to the UK’s ‘mini-budget’ episode in 2022. The parallels are imperfect; the dollar remains the world’s reserve currency, but the mechanism is the same: markets lose patience with fiscal inconsistency. The difference is scale. If the UK’s gilt market hiccup was enough to force a prime minister out of office, a sustained dislocation in the US Treasury market is much bigger (and badder) news.

That’s not yet the assumed outcome yet, but the risks are rising. What makes this moment more complex is the tension it exposes between markets. Bond markets now appear to demand fiscal discipline and tariff revenue. Equity markets, by contrast, have rallied on the prospect of tariff relief and a softer policy stance. These are not compatible objectives. If Trump cuts tariffs to appease investors, bondholders may revolt. If he keeps them high to support revenue forecasts, risk assets may reprice. This is not a stable equilibrium, and I think it will lead to continued choppy markets as we work through this.

The broader backdrop is one of capital competition. For much of the past decade, US stocks and bonds attracted inflows simultaneously, one on growth and the other on safety. That twin demand dynamic is no longer reliable. As positioning shifts, the unchallenged dominance of US assets in global portfolios is facing its most sustained scrutiny in over a decade, leading many to conclude that the dollar could be facing a period of steady decline.

US Economic Data is Still Holding Up (For Now)

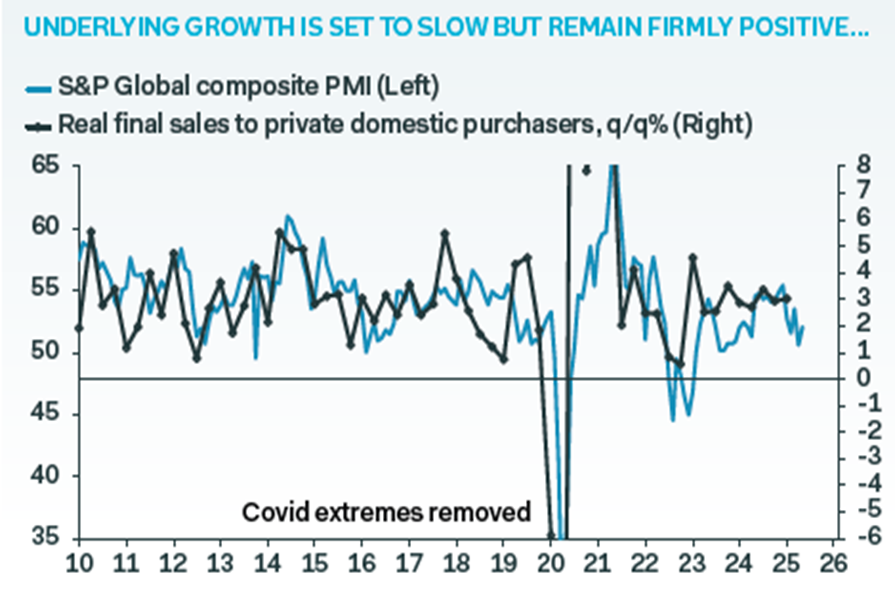

US business activity picked up in May, with the flash composite PMI rising to 52.1, its strongest reading in over a year. Both manufacturing and services showed improvement, suggesting that growth remains steady despite policy noise and global uncertainty. The data points to a slowing US economy but still ticking over, enough to keep recession fears at bay for now.

That said, there were a few less encouraging details. Price pressures appear to be building again, especially in manufacturing, where output prices hit their highest levels since 2022. Services inflation also firmed. Early evidence suggests that the cost of new tariffs is being passed on to consumers rather than absorbed by companies, which could complicate the Fed’s job if it continues. Employment readings softened slightly, hinting at a cooling labour market. But overall, this PMI print will likely reassure equity investors that the economy still has momentum. Bond markets, however, may be less comfortable, with sticky inflation potentially keeping yields elevated.

UK Inflation: A Setback, Not a Rethink

On the quiet, the UK equity market has been doing well this year. It got hit by the Liberation Day Tariffs but not as much as other markets, so it had less to recover and is now sitting firmly positive year to date, with the FTSE 100 up over 8% on a total return basis. Last week, we got the latest inflation update, with April’s print worrying at a headline level, with CPI jumping to 3.5% from 2.6% in March. But beneath the surface, the report offered a more balanced picture that may still support rate cuts in the months ahead. The Bank of England’s preferred measure of underlying services inflation, which strips out volatile and regulated components, actually cooled slightly. Core goods inflation also eased. And despite a sharp increase in airfares and energy bills, there was no sign yet of firms passing on higher wage or tax costs, which many had feared would embed second-round effects.

We think the headline shock shouldn’t derail the BoE’s cutting cycle. Monetary policy remains firmly in restrictive territory, and recent commentary from key MPC members suggests the door to easing remains open. Huw Pill, who voted against a cut in May, explicitly framed it as a ‘skip’ rather than a shift in direction.

Other data was mixed. Retail sales bounced strongly in April, but the underlying momentum remains questionable, with broader services activity subdued and the PMI pointing to a slight contraction. For now, Q2 GDP is likely to remain positive but softer than the surprisingly strong first quarter. In short, whilst April’s inflation data complicates the near-term outlook, it doesn’t change the broader direction. I expect the BoE to ease again in August, with the odds increasing if wage and demand pressures moderate further.

This Week…

The week ahead will pivot around Thursday’s US core PCE inflation release, the Fed’s preferred price gauge. It’s expected to show only modest progress, keeping year-on-year inflation stuck around 2.6% still too high for comfort. Given the backdrop of rising long-end yields and market anxiety over fiscal credibility, any upside surprise here could reinforce pressure on bond markets and delay hopes of rate cuts.

On the micro side, attention will turn to Nvidia’s earnings, which land Wednesday, offering a key read on AI-related momentum and broader tech sentiment. Salesforce, Dell and Costco also report, with the latter providing a useful gauge on consumer resilience. We also get French GDP, German labour market data, and Tokyo CPI, all feeding into the narrative of diverging global growth paths. For now, futures are pointing higher, thanks to Trump’s decision to delay new tariffs on the EU, but this calm may prove short-lived if the data disappoints or if policy rhetoric flares up again.

I hope everyone had a peaceful Bank Holiday Weekend.

DOWNLOADS

There are currently no downloads associated with this article.